Free South Dakota Promissory Note Form Template

The South Dakota promissory note forms on this page are perfect if you are looking to document an agreement to borrow money between two parties.

A promissory note template will cover the following:

- The repayment periods

- The interest rate

- Any penalties for late repayment

- Payback requirements

- Any other terms that both parties agree to

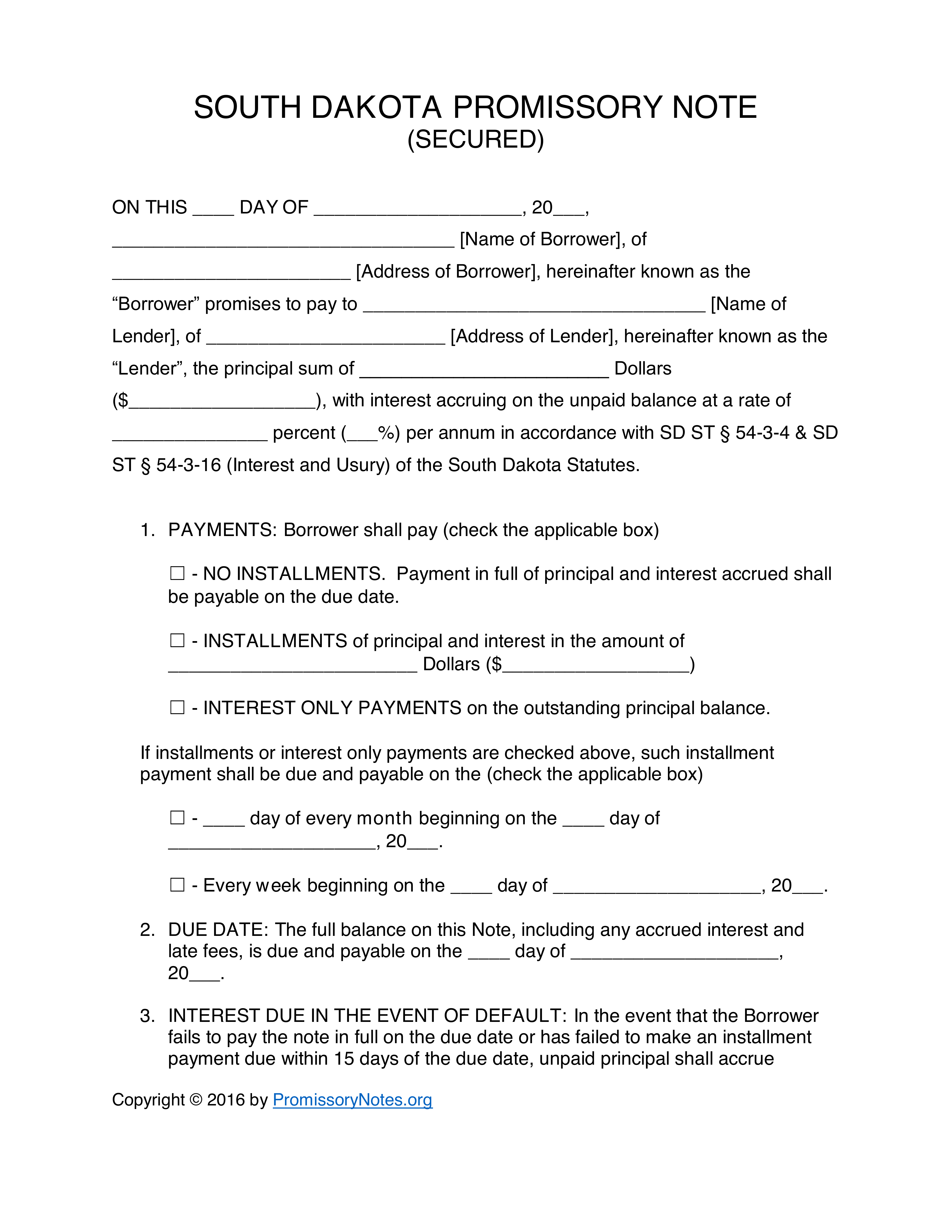

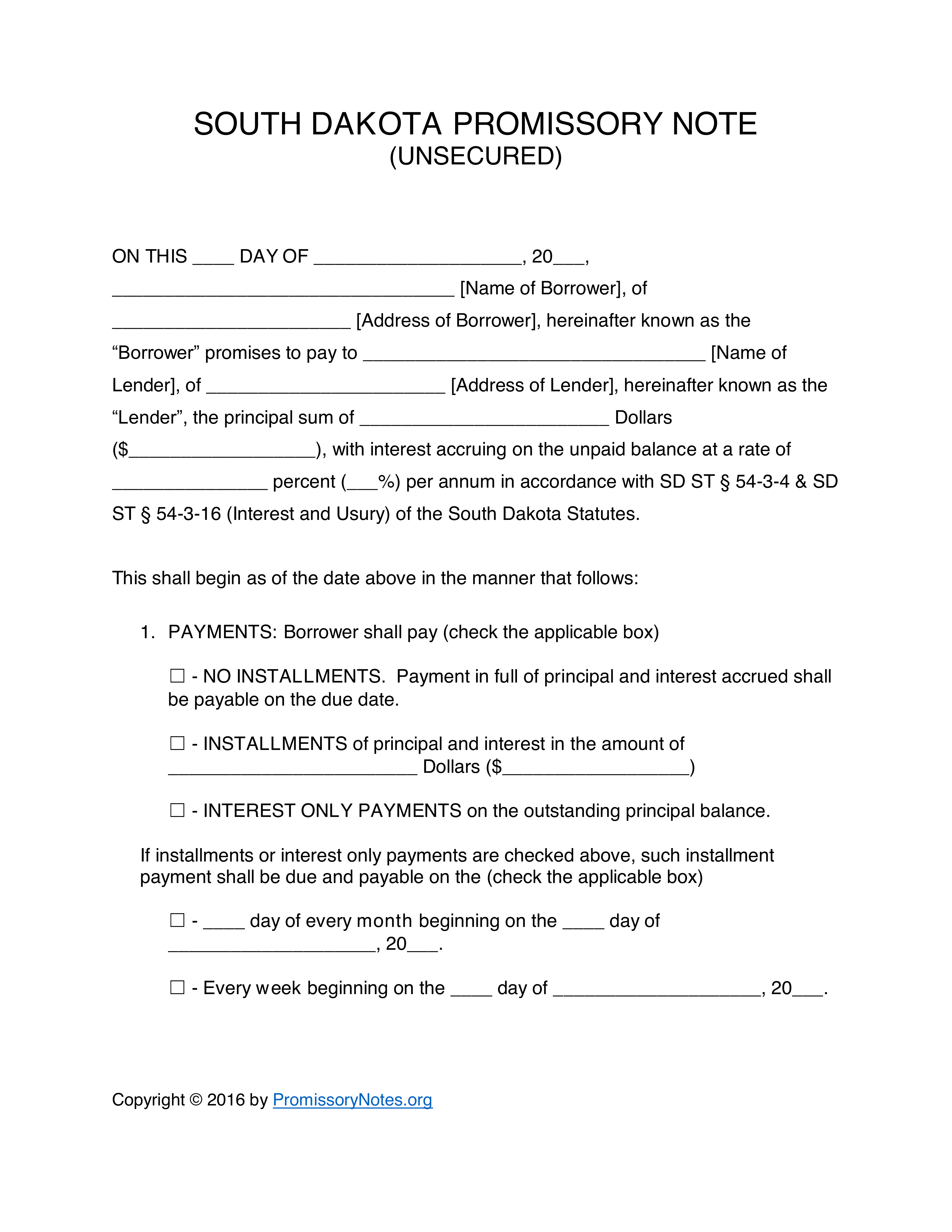

Secured Promissory Note | Unsecured Promissory Note

Download South Dakota Promissory Note Forms

We have both secured and unsecured promissory note templates for use in South Dakota.

- A secured promissory note is a promissory note that is secured by an asset, such as a house or car. If the borrower fails to pay the loan, the lender will be able to recover the loan by selling the asset.

- An unsecured promissory note is a promissory note that is not secured by an asset, such as a house or car. If the borrower fails to pay the loan, the lender will not be able to recover the loan and would need to take legal action.

South Dakota Unsecured Promissory Note Form Download PDF Download Word

Please note that the promissory note forms on this page are not created by us. Make sure to check with the source before using them for your own purposes.

How to Write a Promissory Note for South Dakota

Promissory notes are a legal document, but writing one doesn't have to be complicated.

In order to properly document the agreement to lend money from one party to another, the promissory note should have the following elements:

- The date of the agreement

- The name and address for borrower and lender

- The principal amount of the loan

- Whether the loan is secured or unsecured

- If the loan is secured, what is the collateral asset?

- In what circumstances can lender take possession of the collateral asset?

- The repayment schedule

- The due date for payments

- The interest rate

- Whether the loan has a cosigner, and if so, who is it?

These are the basic details required, although we would recommend using a form that has already been created to save you time researching the necessary details.

It's also worth nothing that you should check the usury laws in South Dakota before deciding on the interest rate for the loan.

Each state has its own laws for the maximum interest you can apply to the loan, and you need to adhere to these laws to ensure that the agreement is legal.

Signing South Dakota Promissory Notes

Although it is not necessary for the document to be legally valid, it is recommended that you have a lawyer who is licensed to practice in South Dakota check the promissory note agreement to make sure it is legally sound and does not violate state laws.

When you're happy with the promissory note, the lender, borrower, and any cosigners should sign it. You can also have a lawyer notarize it for you (in the event of a court case this proves no signatures were forged).

Keep a copy of the promissory note for your records and make sure to keep it safe. We recommend an online copy stored in Google Drive or similar, a copy on your hard drive, and a physical copy in a locked filing cabinet.

Making Changes to a Promissory Note

It is possible that changes to the agreement may be needed, particularly for longer repayment periods. To do this, all parties must agree.

The best practice is to create a second promissory note as an amendment to the original. This way, you can highlight the changes being made, and have all parties sign it just as you did before.

Conclusion

Hopefully this article has helped you understand how to write a promissory note for South Dakota.

You can use the templates above as a guide and always consult a lawyer where possible to ensure you are following South Dakota state laws.